AI for Finance: breaking barriers

There’s a high demand for AI in finance, but also many barriers. Read how ValueXI takes them over and helps adopt AI for banking in a business case.

April 8, 2024

In the financial sector, there’s a high demand for AI due to its ability to address various tasks such as customer scoring, anti-fraud and financial monitoring, document processing, and request management, to name a few. However, the industry faces hurdles in fully adopting this technology, preventing it from realizing its full potential. Fortunately, ValueXI can help address many of these challenges and allow financial institutions to squeeze the most out of Artificial Intelligence.

AI capabilities for financial institutions

Artificial Intelligence addresses a variety of major issues in the financial world, including those related to market risk analysis, insurance claims fraud, enhancing customer experience, ensuring regulatory compliance, financial forecasting, and improving financial security.

In particular, Large Language Models (LLMs) are gaining significant interest today for their ability to sift through vast financial data, provide insights for investment decisions, offer personalized savings recommendations, deliver 24/7 customer support, and more.

As far as we've been able to ascertain by analyzing industry, the most trending areas of AI application by financial sector are:

- Risk management: AI predicts creditworthiness and potential defaults using customer data, enhancing loan underwriting and managing investment risks.

- Client scoring: AI models assess client risk profiles for credit, loans, and insurance products, improving client segmentation and pricing.

- Customer service: LLM-powered chatbots provide 24/7 customer support, handling inquiries and transactions efficiently. Furthermore, AI is good at offering personalized investment and savings advice by analyzing customer behavior.

- Relationship intelligence: AI-powered CRM platforms centralize and interpret contact records, ensuring a more efficient deal management through personalized communication.

- Fraud detection: AI monitors transactions to identify fraud, complying with anti-money laundering regulations and ensuring legitimate insurance payouts.

- Algorithmic trading: AI algorithms help execute trades at optimal times based on market data analysis, maximizing profits.

- Automated underwriting: AI evaluates risks and determines insurance premiums accurately, predicting future claims and ultimately improving insurance product pricing.

- Compliance and reporting: AI automates compliance checks and Know Your Customer processes, enhancing anti-fraud measures and regulatory compliance.

- Predictive analytics: AI analyzes historical and real-time data to predict financial trends and market behavior.

While the benefits are so enticing, what holds back banks, insurance companies, and other financial institutions from fully adopting AI? What are the most common problems they face?

Barriers in adopting AI

According to some reports made by finance media, the most prevalent issues include:

- High cost: the substantial investment required for AI implementation remains a daunting obstacle for many financial institutions. The idea of spending a lot of resources on hypothesis testing and subsequent model integration does not sound very attractive.

- Lack of trust: concerns about accountability and the interpretability of AI outputs hinder the establishment of trust, particularly in critical areas like fraud detection and loan approvals. Furthermore, since LLMs learn from historical data, there’s a risk of perpetuating existing biases, leading to unfair or discriminatory outcomes.

- Operational risks: integrating AI, especially Large Language Models (LLMs), into critical financial operations introduces operational risks such as system failures or errors that could lead to financial losses or disruptions.

- Data availability and quality: AI models demand vast amounts of high-quality data for training, yet many institutions lack sufficient digitized data and struggle with data accuracy and consistency.

- Data privacy and security: ensuring the protection of sensitive customer data and compliance with privacy regulations is paramount, as AI systems can be vulnerable to cyber-attacks. Legacy LLMs pose additional security risks. The non-compliant nature of LLMs (ChatGPT, LLaMA, Claude etc.) pose additional security risks.

- Talent shortage: implementing AI projects requires skilled data professionals, but there is a global talent gap in AI expertise. Banks and other organizations may face challenges in upskilling their existing employees or recruiting new talent with expertise in AI, Machine Learning, and Data Science.

- Legacy systems: outdated IT systems pose compatibility challenges and hinder seamless integration with AI technologies.

- Ethical considerations: AI raises ethical concerns regarding job displacement, fairness, and bias, as well as environmental impacts.

- Regulatory compliance: adhering to governmental regulations presents complexities due to the evolving nature of AI technologies.

- Reliance on external providers: dependency on external LLM vendors can lead to disruptions and compromises in service quality.

Some of these challenges require broader business strategies, risk management approaches and targeted training programs, to achieve a comprehensive AI framework within the organization. However, the ValueXI platform offers swift solutions for many obstacles obstructing AI adoption in the financial sector, all while improving efficiency in AI implementation, and mitigating risks associated with data, development, and integration.

ValueXI comes to the rescue

ValueXI provides a solution to overcome these hurdles and accelerate AI project development in the financial sector:

- Cost-efficiency:ValueXI helps financial institutions optimize resource allocation and ensures a quick transition from Proof of Concept (PoC) to a production-ready AI project in just one month.

- Speed: ValueXI enables quick hypothesis testing cycles and streamlines data preparation, integration, and feature implementation. It also ensures a rapid project start with reduced Data Scientists involvement.

- Security: with options for cloud or on-premises deployment, ValueXI ensures data privacy and security compliance, mitigating common threats. While working with an enterprise-level LLM module, ValueXI offers integration with the LLM’s API, which enables secure data processing within your system.

- Risk-free: AI projects powered by ValueXI avoid development-related risks and feature smooth end-to-end AI integration.

- Versatility: ValueXI serves multiple purposes, acting as an engine for a custom enterprise-grade AI solution delivery, AI feature add-on, or development tool.

- Support: gain access to continuous guidance from an experienced Data Science team with specialized expertise in finance. Your in-house Data Science teams, if available, will also benefit from the automation of routine tasks provided by ValueXI.

Use case — ValueXI for Finance

Client: A major private bank focused on retail lending with over 200 nationwide banking facilities and more than 36 million clients.

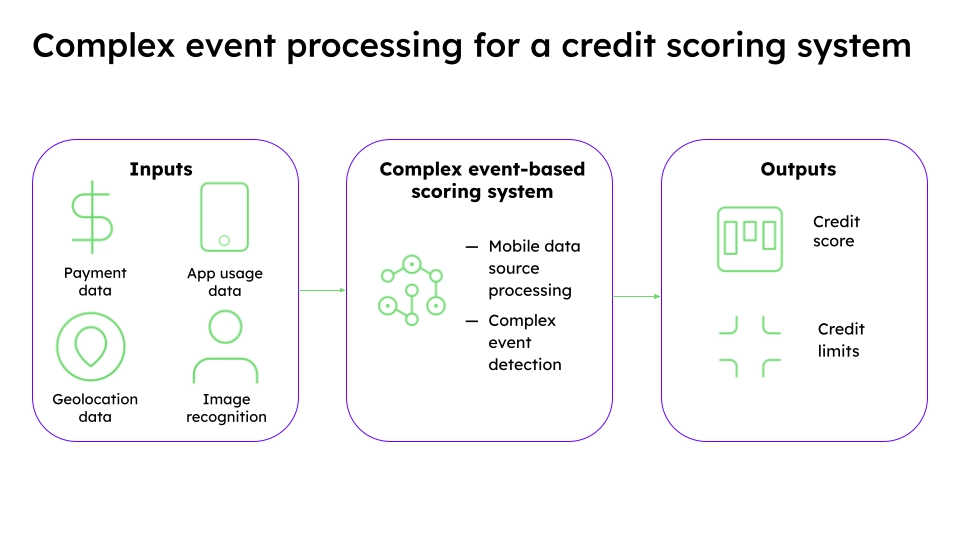

Business goal: Improve a credit scoring system by introducing a high-load complex event processing system.

Solution: A cloud-based scoring system model was developed. It detects customer-related events, and then uses fresh events as well as accumulated historical data to estimate/update the bank customer’s credit score for this customer, and calculate the credit limit available to them.

The system normally works in real-time mode, but also can deliver batched tasks. The app used inputs such as:

- Installed apps on the customer’s phone, and their usage

- Number of logins in the bank mobile app per day

- How often the customer changes their phone device

- Matching the customer’s geolocation with points of interest in that area, etc

Result: The acceleration of the credit scoring system has facilitated the attraction of more clients and the expansion of the customer base.

It takes less than 1 hour to calculate 30 predictors for a sample of 1 million clients.

Resume

How ValueXI can help adopting AI in finance

With ValueXI, financial institutions can utilize a platform instead of expanding their DS team, speed up the AI development process while optimizing resource allocation, minimize risks, and ensure the model output is reliable and applicable to their business needs. To top it off, ValueXI allows the use of LLMs while ensuring GDPR/CCPA compliance and keeping data entirely internal.

We invite you to book a demo!

Explore ValueXI through a 15-min live demo, and experience firsthand how the platform enables a risk-free and smooth AI adoption, while maximizing the benefits of AI for your business.

We are also open to share our domain-specific expertise and details on AI projects in finance, just drop us a line at [email protected]

Accelerate AI services integration X3 fast and X5 cheaper with ValueXI

Request a demoYou may also like

Corporate AI with ready-made pipelines

Discover how ValueXI’s pre-configured AI solutions are automating and optimizing workflows across business units — from Sales and Finance to HR and Support.

January 20, 2025

Why AI is a must-have for leasing companies

Explore how AI can help leasing businesses solve key challenges and why adopting new technologies is essential for success in this sector.

December 19, 2024

Workshops as the first step towards mastering AI

In the complex field of AI, identifying the best approach and securely launching an AI project can often be more challenging than selecting the right tools. To help bridge this gap, we recommend expert-led training sessions that connect theoretical knowledge with practical application, guiding you through the complexities of AI implementation.

November 7, 2024